From great economic progress to building a better quality of life, energy is the driving force behind everything

From great economic progress to building a better quality of life, energy is the driving force behind everything. While living in the 21st century, individuals and societies have become significantly dependent on its potential, abundance, and convenience. It’s an undeniable fact that energy is propelling industries, sustaining societies, and boosting economies. Consider a power outage just for a few minutes, living without energy; it demonstrates how ineradicable its imprint is on your life, particularly on your daily activities. While it is making individuals’ lives easier and business goals achievable, on the other hand, it’s becoming more difficult for energy industries to keep up with the rising demand. That being said, the global economy is highly likely to consume even more energy in the future. In other words, higher global energy demand, dependence on fossil-based fuels for energy production and increasing population have lead to an inevitable energy crisis.

Europe on the Edge of Energy Crisis Believe it or not, the energy generated from fossils-fuels fulfills 80% of your current energy needs, which includes sources like coal, oil, and gas. However, the stated stats are anticipated to increase by half over the next couple of decades. This situation has been causing fear among many that we will run out of energy and it can lead to devastating consequences for the global economy. Speaking of the past two decades, oil reserves have increased by 40% and gas reserves by 70%; however, the expected rising demand indicates that the world will run out of renewable energy resources after 30 years.

Fossil-Fuels; the Devastating Energy Production Process for Earth However, the process for generating energy from fossil-fuels takes a huge toll on our ecosystems and landscapes. The unearthing and mining of huge areas to explore coal or oil deposits have drastically been destroying and leaching nutrients from lands, making them unfit for agriculture. This devastating process fragments and destroys the critical wildlife habitat. Furthermore, fossil fuels are non-renewable energy resources that release harmful air pollutants before burning. According to a report, around 12.6 million people in the US are exposed to toxic air pollution daily from oil and gas wells. These air pollutants include benzene and formaldehyde, which can cause leukemia and other dreadful diseases, including cancer. Besides, CO2 emissions in the atmosphere and burning of fossil fuels for energy are two of the major causes of rising temperatures. With the advancement in various economies, scientists have realized the disastrous consequences of burning fossil fuels for energy and come up with a new approach to keep up with the energy demand; they have developed technology that could derive energy from renewable sources. A product of natural resources like solar, wind, tidal, geothermal, biomass, and hydro, green energy has proven to cause no harm to our ecosystems. In addition, the renewable energy industry in Europe is also fostering technological innovations and development across the continent.

Green Energy While considering the aforementioned facts, many European countries have been encouraging and switching to the idea of utilizing ‘green energy’. That being said, the renewable energy revolution has taken off around Europe steadily. According to a report, Europe obtains more than 30% of its energy from renewable resources. While considering the escalation in energy demand, it’s expected that the proportion of renewable energy will increase by up to 50% by 2030. Considering the bright future of renewable energy, let’s take look at what it holds for investors in the long run.

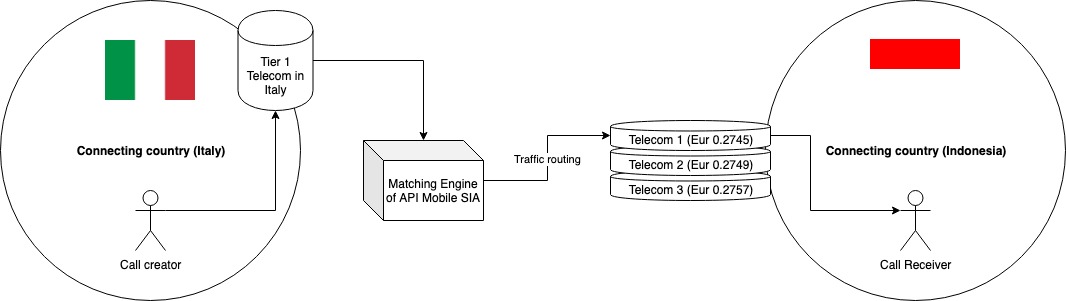

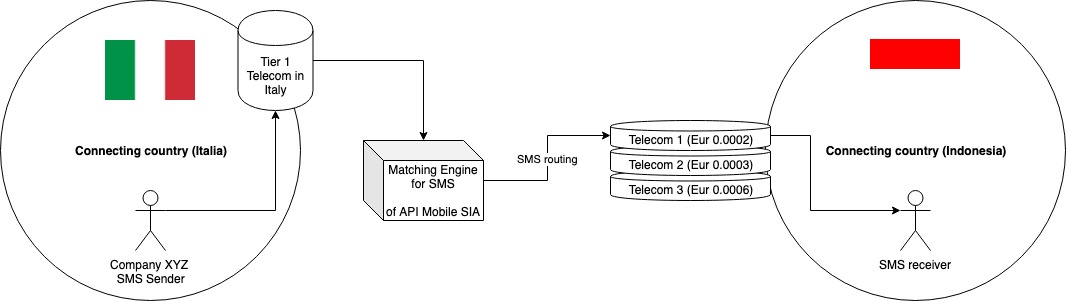

Investing in the Green Energy Industry The global green energy industry amassed a total of $476.3 billion in 2014 and future projections by a BBC report indicate that the industry will grow at a 10.3% annual rate by 2019. Now, renewable energy is becoming more economically viable, luring consumers to shift to these technologies along with growing concerns over fossil-fuel energy production. Speaking of investors, they are reconsidering the market for making investments. If you talk about the future of the renewable energy industry, the future seems ‘green’; a report reveals that this particular sector will receive around $5.1 trillion in investment by 2030. Moreover, investing in the renewable energy industry, particularly in wind parks, is certainly a profitable idea for investors.

The Bottom Line Today, Europe is the center of the renewable energy revolution, and has made a great impact on the fossil-fuel energy production industry. For safer, cleaner, and more secure supply of energy needs, European citizens and businesses are shifting their focus toward green energy. Keeping the aforementioned details in view, the future of green energy seems economically viable.