Today, after a very intensive months of research, structuring of the business we finally submitted the prospectus for Enercom AG through Florian Scheiber our Legal advisor to the FMA Liechtenstein. Many of you did not probably know but the European Securities and Markets Authority (ESMA) recently published new guidelines on how a prospectus needs to be structured – as we thought we would be able to submit prior to that deadline we completely structured the prospectus based on the old template as FMA was also not sure whether they can provide the first set of feedback within this timeframe. So we had to decide to adopt the prospectus to the new guideline in order to submit it to the FMA in Liechtenstein. A big thank you to the team and also Florian Scheiber for helping us navigate through this big task for Enercom AG. So we could say we were the first prospectus submitted towards FMA Liechtenstein with the new prospectus regulation in the area of telecommunication and renewable energy as tokenised equity of an Aktiengesellschaft which was incorporated in February 2019 in Liechtenstein.

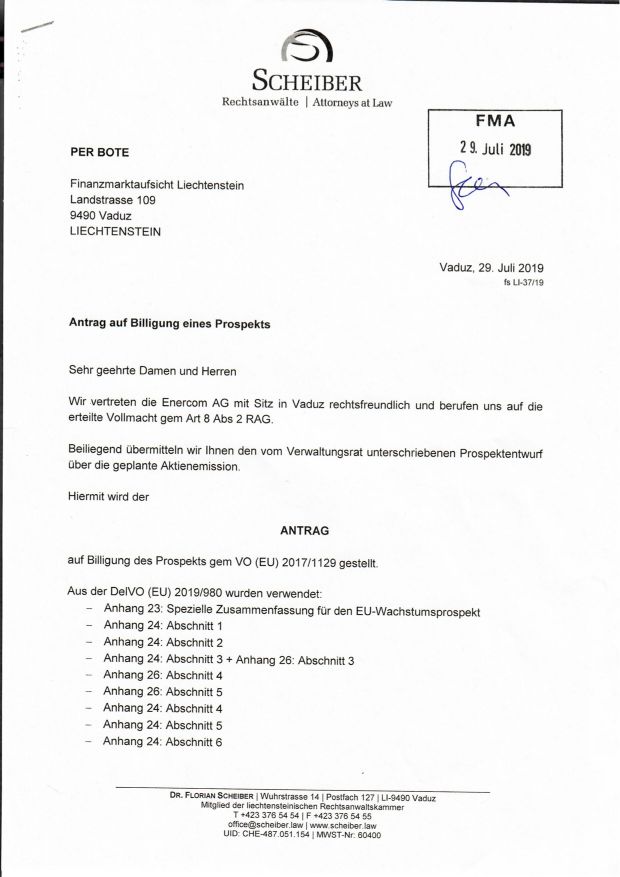

See below the document which we submitted to the FMA.